Expertise

Best Vat Fraud Solicitors | London & UK

We are best-in-class Vat Fraud Solicitors, renowned nationally as top HMRC Investigation Carousel and Missing Trader defence lawyers.

Our enviable reputation is built on our proven track record of successfully representing defendants charged with Carousel and Missing Trader (Intra-Community – MTIC) customs duty evasion.

We repeatedly obtain outstanding client outcomes for both individuals and businesses facing pending or active HM Revenue Customs tax duty investigations.

The evolving nature of tax law, together with changing tax-payer declaration responsibilities, means that tax rules can be open to interpretation.

Our leading Bark & Co Law Firm’s Vat specialist tax defence solicitors recognise that every client case therefore needs its own careful analysis which then leads to our bespoke strategic plan for them when under an HMRC Value Added Tax investigation. This is why we regularly secure the best possible dispute resolution(s) for our clients and eliminate or minimise any penalties and legal consequences.

HMRC Vat Tax Compliance | The Role of Vat Fraud Litigation Lawyers

Did you know that nearly £10 billion of Vat is reportedly under-received by HMRC each year?

This jaw-dropping figure isn’t just a statistic – it’s a wake-up call for any individual or business at risk of a VAT fraud allegation. In a legal landscape where even a minor error can lead to devastating consequences, engaging the best vat fraud solicitors is not just smart – it’s crucial.

Whether you’re facing an active or pending VAT fraud investigation and need to retain the very best UK Vat fraud defence specialist lawyers, or simply want to fortify your business against costly mistakes, our expert honed legal expertise will steer you through the choppiest of waters.

Experienced VAT Fraud Defence | Top-Rated Bark & Co Law Firm’s leading HMRC Tax Investigation Litigation Solicitors

Approximately £10 billion is lost annually to VAT fraud in the UK – a staggering figure that highlights just how critical expert help is when facing a Vat fraud investigation or allegation.

Engaging the very best vat fraud defence solicitors can make all the difference between financial disaster and a successful fraud defence. VAT fraud is a minefield for the uninitiated, and the numbers don’t lie — mistakes are both common and costly. Proactive and robust top-rated fraud defence is an absolute must if you want to avoid becoming the next cautionary tale.

Our Bark & Co Law Firm specialises in defending both Vat and none-Vat related tax evasion allegations. Our deep and extensive knowledge about complex tax law enables us to employ our carefully developed tactical and strategic insights for best client outcomes.

Whatever part of HMRC’s process you are in, because we are nationally known as top-rated crime solicitors, we act as your shield of protection during allegation, investigation and prosecution – and then artfully handle any dispute resolution penalty.

With HM Revenue & Customs deploying increasingly sophisticated tools to identify potential VAT fraud, expert legal advice can be the one factor that keeps you or your business protected while others fall victim to prosecution.

The stakes couldn’t be higher. Skilled top-tier expert legal representation translates directly to your financial survival, peace of mind, and bottom line.

Our UK London-based best-in-class Vat fraud solicitors ensures:

✓ every aspect of your case is examined

✓ every piece of evidence is challenged

✓ every legal right is robustly defended

Whether your issue is tax errors or accusations of using fraudulent Carousel / Missing Trader schemes, our top-rated expert legal guidance can make the decisive difference.

Remember, expert legal advice is not a luxury – it is your shield against HMRC’s potent investigative resources and legal consequences.

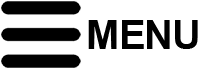

Fraudulent Vat Returns & Reclaims | Input Tax & Output Tax

Vat Output Tax | False Vat Return Declaration

Vat Input Tax | False Vat Return Declaration

Output Vat fraud is the misrepresentation of how much a business charges to its customers or clients on the sale of its goods or services. The total amount of Vat charged is owed due to the UK government.

Falsely deflating the Output Value therefore decreases the amount that is owed to the UK government.

Choose the Best Vat Fraud Solicitors | London & UK | Top-Rated Bark & Co Law Firm

Choosing a solicitor to legally represent your case in an HMRC fraud investigation is a major decision with expensive repercussions if mishandled.

Our top fraud defence lawyers possess BOTH specialist HMRC Vat and none-Vat tax fraud expertise. Our extensive tax fraud track record of client outcome success rests on our skill and deep knowledge of dealing with all crime regulatory bodies such as the FCA (Financial Crime Authority) and the SFO (Serious Fraud Office).

Time and time again we achieve best possible outcomes for our HMRC tax evasion clients.

After we careful analyse your cases, we will always be upfront and communicate expectations clearly. We will partner with you to structure the best fraud defence strategy, and handle all HMRC communications to lessen your risk.

Our nationally leading top-rated HMRC Carousel and Missing Trader (Intra-Community) Law Firm’s specialist fraud lawyers will:

1. Leverage case law

2. Explain in detail how our HMRC investigation tactics work

3. Create bespoke strategies for the strongest defence

4. When applicable, expertly negotiate best dispute resolutions

Bark & Co Solicitors | Carousel, Missing Trader Intra-Community (MTIC) Vat Tax Evasion Fraud Defence Specialists

It’s a criminal offence under UK law and includes offences such as tax evasion, fraudulent VAT reclaims, and complex criminal arrangements like Carousel and MTIC schemes.

The difference between routine tax errors and deliberate fraudulent intent can be a line that only the best vat fraud solicitors can help you navigate.

It is important to appreciate that tax evasion of all kinds remains one of the gravest of offences, and can have a devastating effect on both individual and commercial interests – and not least destroy hard-won private and brand reputation.

A key element of the UK’s regulatory approach is the swift identification and prosecution of fraudulent actors by HMRC and other government agencies. The UK is especially vigilant regarding types of VAT fraud, both notorious for causing massive losses to the treasury.

Comprehensive fraud investigations frequently extend to:

• partners

• directors

• accountants

• and any person in a position of financial authority within a business.

The net of risk is wide.

HMRC Vat Fraud with Money Laundering Allegations | Bark & Co Law Firm for Serious Financial Crime Defence

In such cases, it is absolutely critical to have the most highly experienced and best-in-class top criminal defence fraud specialist lawyers represent you.

Here at Bark & Co, we have an almost unparalleled record of obtaining first-class outcomes for the clients we defend where the allegations may additionally involve none-HMRC regulatory crime bodies like the SFO (Serious Fraud Office) and the FCA (Financial Crime Authority).

Vat Fraud Consequences | Asset Seizures, Confiscation & Restraint Orders, Crown Court Trials, Custodial Prison Sentences

The landscape in the UK is tough, but with the support and guidance of our best-in-class Vat fraud specialist HMRC Vat fraud solicitors, businesses and individuals will be far better able to protect themselves against both harsh prosecution and the potentially crippling financial impact of proceedings.

Conspiracy to Defraud | Carousel & Missing Trader Intra-Community (MTIC) Schemes | Value Added Tax Evasion

Carousel fraud is so named because the goods—often high-value electronics commodities like mobile phones — literally “carousel” through a circle of companies. Each stage is designed to maximise fraudulent VAT reclaims and obscure the money trail from tax authorities.

These cases are often complex. Having our experienced Vat fraud defence specialist lawyers with extensive understanding of the Law and HMRC Tactics is invaluable.

Convictions in carousel fraud and missing trader schemes can lead to long prison sentences, substantial fines, and reputational ruin.

Our successful fraud defence strategies include those that that challenge the prosecution’s narrative. We analyse every aspect of the transaction chain to expose procedural prosecution flaws.

Our painstaking, technical case work backed by our best-in-class expertise in ALL kinds of HMRC Tax Investigation defence including cross-border, multi-jurisdiction tax law, repeatedly obtains best possible client outcomes.

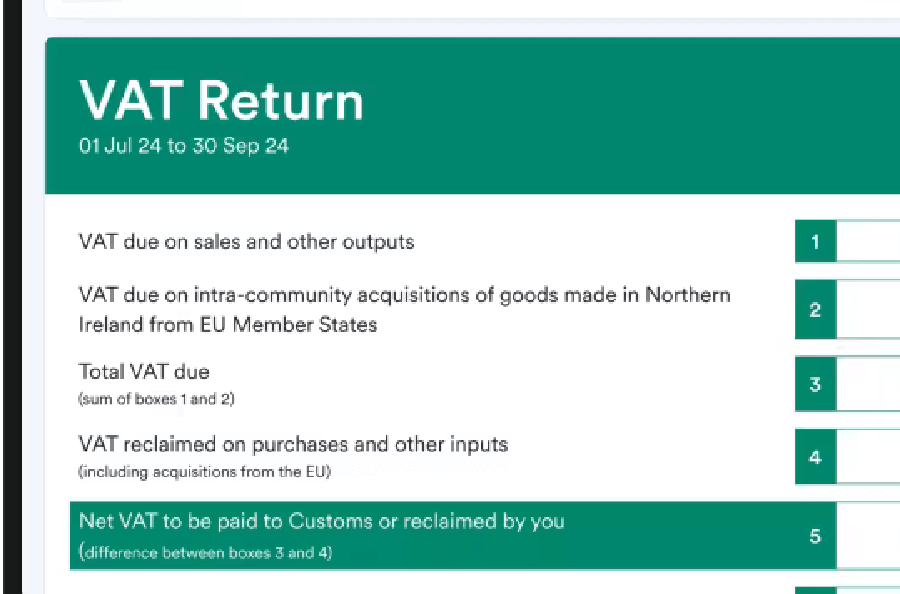

Carousel & Missing Trader (MTIC) VAT Fraud | How it Works

2. Instead of handing the VAT to the government, the importing company is shut down and the cash is kept by the importers.

3. This loss of tax is often compounded when the new owners of the goods export them again and can legally reclaim the VAT they paid.

4. Goods go round in a “carousel” via bogus supply chains within and beyond the EU because they are repeatedly imported and exported.

5. By exporting the goods to Dubai for example, the alleged fraudsters break the evidential chain making the fraud harder to detect.

6. Further, if a trading entity within the transaction chain ceases to exist, the entity becomes known as a “Missing Trader“.

Bark & Co Premier Law Firm | Nationally Recognised Top-Rated UK London-based Vat Evasion Legal Defence

Our defence process encompasses comprehensive, painstaking forensic accounting examination of clients’ financial conduct including the tax filings period in questions, and all previous correspondence with HMRC. Key to a strong defence is ensuring that our clients do not make self-incriminating statements or surrender privileged information without our legal approval – mistakes in early interviews can have irreversible consequences.

Tactics & Defence Strategy | Carousel & Missing Trader MTIC HMRC Vat Investigations

Some Vat Fraud Defence Strategies Used by Our Leading Expert Solicitors

Our best-in-class Vat fraud solicitors know tactically when and strategically how, to deploy the components in their armoury, including:

• using forensic accountants to meticulously analyse the evidence

• contesting the chain of events, where viable

• calling expert witnesses

• submitting detailed legal arguments highlight prosecution flaws

• creating technical legal arguments regarding VAT registration

• leveraging their established relationships with the UK’s very best specialist tax barrister KCs

In essence, we assess each case individually, crafting a tailored approach that leverages both legal precedent and credible doubt.

As our nationally recognised top-rated fraud and financial crime specialist Founder Solicitor and Principal Giles Bark-Jones says:

Specialist White-Collar Crime Firm | Proven Experience in Vat Fraud Cases

FAQ’s | HMRC Vat Fraud Investigation Defence Solicitors

Bark & Co are nationally recognised as leading VAT fraud solicitors, based in London but representing clients across the UK. We have an outstanding and proven track record of achieving successful outcomes when representing clients in HMRC VAT investigations cases, including those involving Carousel and Missing Trader (MTIC) scheme fraud allegations. Our outstanding successes rest on our careful, expert and imaginatively crafted bespoke defence strategies developed specifically for each different case. We robustly challenge and rebut, we minimise penalties, we protect reputation, and we deliver best legal outcomes possible.

Our solicitors have decades of experience handling HMRC VAT investigations, tax evasion allegations, and complex MTIC and Missing Trader fraud prosecutions. We are specialists in both civil and criminal defence, with deep knowledge of how HMRC, the Serious Fraud Office (SFO), and the Financial Conduct Authority (FCA) operate.

Carousel and Missing Trader VAT fraud schemes are highly technical and aggressively pursued by HMRC. Bark & Co’s defence lawyers use forensic accountants to expose any HMRC transaction chain flaws. Additionally we deploy selected expert witnesses and if necessary leverage our close professional relationships with the UK’s top tax defence barrister KCs who implement both a detailed transaction case analysis and also build a legally sound and robust defence presentation which challenges the HMRC’s narrative, expose holes in the legality of the prosecution’s case.

VAT fraud convictions can result in heavy fines, disqualification as a company director, asset seizure and confiscations, and a possible custodial sentence. However, with Bark & Co’s best-in-class expert VAT fraud solicitors fighting your corner, we always focus on eliminating wherever possible, and if not possible, reducing the severity of all legal consequences.

You should contact a VAT fraud solicitor immediately if HMRC begins an investigation. Early legal advice is critical to avoid self-incrimination, prevent procedural mistakes, and ensure your case is strategically defended from the outset. Bark & Co handle all HMRC communication on your behalf.

Our reputation is built on consistent success defending individuals and businesses in HMRC VAT investigations and tax fraud prosecutions. We combine deep legal expertise, strong advocacy, and a proven history of achieving the best possible outcomes for clients facing VAT fraud allegations in London and across the UK.

Yes. Bark & Co’s VAT fraud defence lawyers are experts in the full range of criminal fraud - including money laundering, conspiracy to defraud, and all manner of high-profile complex cross-border financial crime. Our multi-disciplinary expertise ensures clients receive comprehensive protection, no matter how serious the allegations.

Speak to us on 020 7353 1990 or email us here.